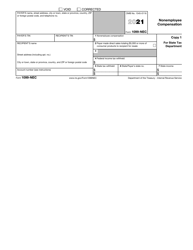

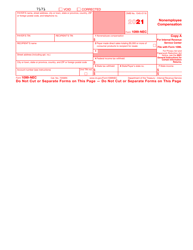

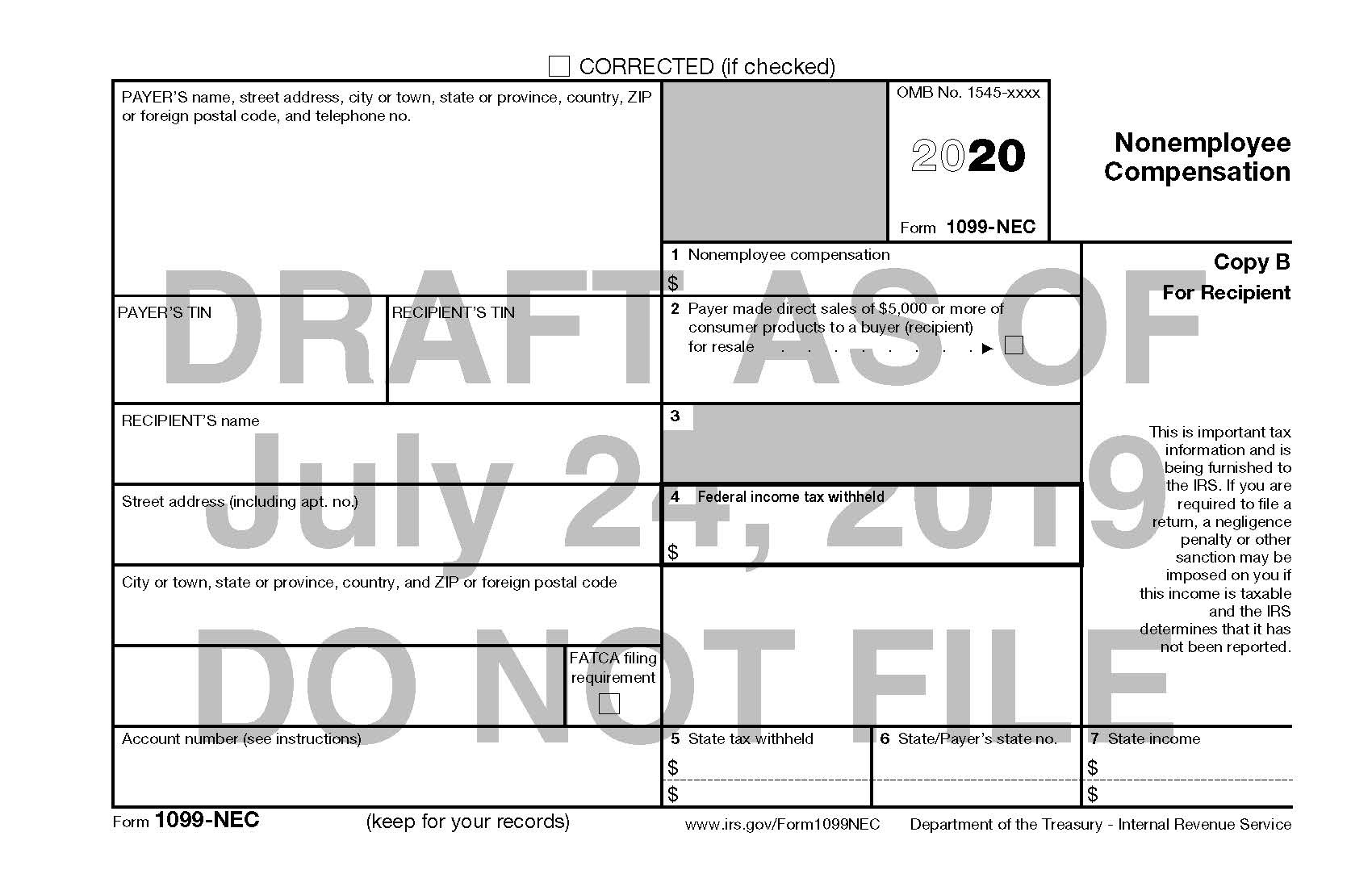

The IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NECOct 01, · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC formFederal tax withheld on nonemployee compensation (Box 4) Enter backup withholding For example, persons who have not furnished their TINs to you are subject to withholding on payments required to be reported in box 1

What Is Form 1099 Nec Who Uses It What To Include More

Form 1099-nec nonemployee compensation worksheet example

Form 1099-nec nonemployee compensation worksheet example-Feb 22, 21 · Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NEC PDF Information about Form 1099NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to fileApr 02, 21 · A business will only use a Form 1099NEC if it is reporting nonemployee compensation If a business needs to report other income, such as rents, royalties, prizes, or awards paid to third parties,

Setting Up And Processing Form 1099 For Recipients

Form 1099NEC is a new IRS tax form designed to report Nonemployee Compensation #2 Who will need to file 1099NEC Beginning with tax year , you will need to file Form 1099NEC, Nonemployee Compensation (NEC), for each person in the course of your business to whom you have paid the following during the yearSep 17, · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC formLearn the rules to correctly report 1099NEC, Nonemployee Compensation, and the most

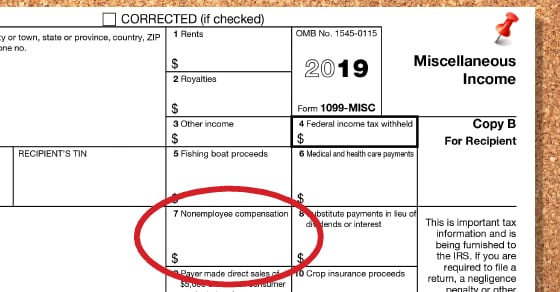

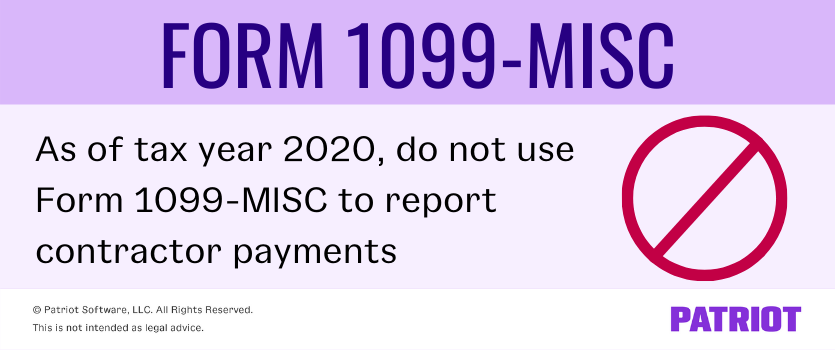

The goal of this article is to share details on the return of IRS Form 1099NEC and how it should be used instead of the IRS Form 1099MISC when reporting compensation for nonemployees FORM 1099NEC Starting in tax year , Form 1099NEC will be used to report compensation totaling more than $600 (per year) paid to a nonemployee for certainAll nonemployee compensation must be reported on the Form 1099NEC Nonemployee payments are any person or business you've paid more than $600 in a tax year in exchange for performance of servicesNov 18, · Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in Box 1 on the 1099NEC It should be noted that Form 1099NEC was previously used by the IRS until 19 when the IRS added box 7 to Form 1099MISC and discontinued the 1099NEC form

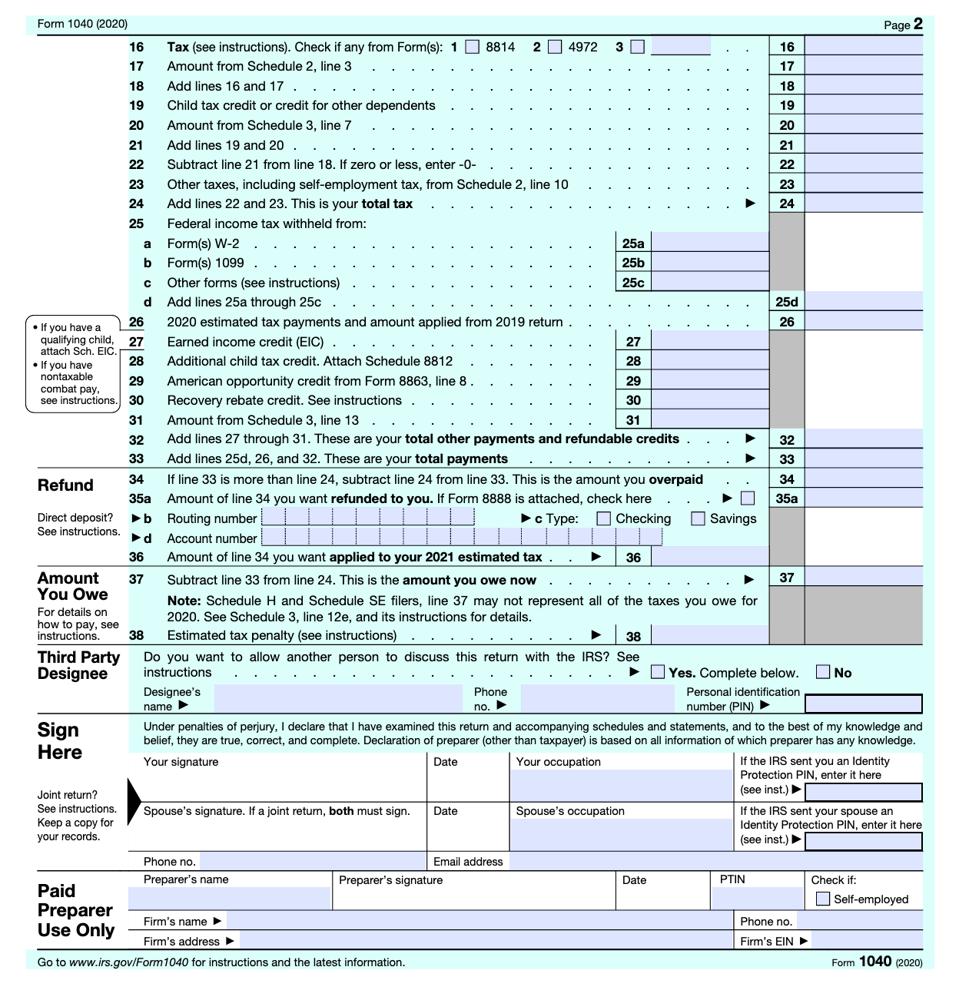

Sep 15, · The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC (the NEC stands for nonemployee compensation) This form will be used to report nonemployee compensation in place of the 1099MISC, which has been used since 19 to report payments to contract workers and freelancers Form 1099MISC hasAug 05, · Introducing IRS's New Form 1099NEC, Nonemployee Compensation By Brett Hersh Published , Edited 08// Share $25 OFF For video training featuring indepth information like this, purchase the 1099NEC & 1099MISC Training Course course today!Feb 08, 21 · Income reported on Form 1099NEC must be reported on Schedule C, the program needs to link these two forms together to be sure that it is reported correctly and on the right form If you have already entered your 1099NEC, you will need to revisit the section where you entered the Form 1099NEC on its own and delete that entry Follow these steps

How To Prepare For The New Form 1099 Nec

Irs Brings Back Form 1099 Nec Cash Tax Accounting

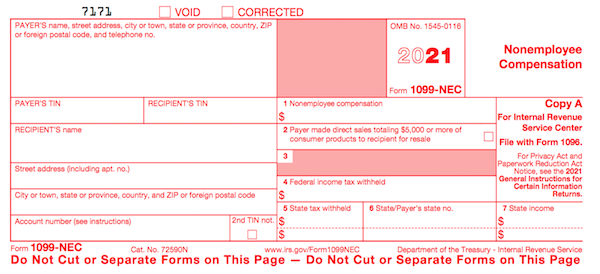

Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeJan 05, 21 · If you need assistance with filing 1099NEC or have questions related to this issue, please give this office a call You can complete the 1099NEC worksheet and forward it to this firm to prepare 1099s Also, make sure you have all of your nonemployee workers or service providers complete a Form W9 forMay 07, 21 · Download Form 1099NEC Nonemployee Compensation Here is a link to a downloadable Form 1099NEC for the tax year 21 Copy A of the form is in red;

The 1099 Misc Filing Date Is Just Around The Corner Are You Ready Carson Valley Accounting

Gx8mo37rphnuhm

Nov , · NEC stands for "nonemployee compensation," and Form 1099NEC includes information on payments you made during the previous calendar year to nonemployees You must send a 1099NEC form to any nonemployees to whom you paid $600 or more during the year This form is NOT used for employee wages and salaries Use Form W2 to report these paymentsJan 08, · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use thisDownload Fillable Irs Form 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Nonemployee Compensation Online And Print It Out For Free Irs Form 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Form 1099 Nec What Is It

Ready For The 1099 Nec Robert S Tax Service

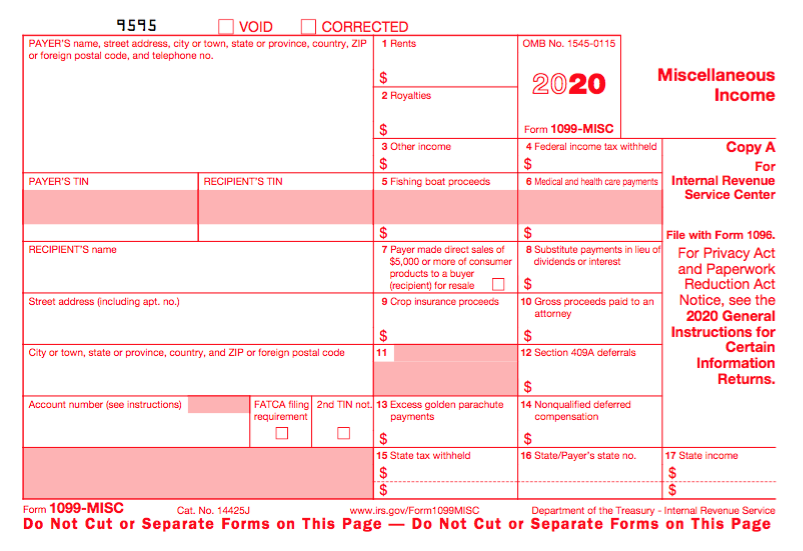

Dec 30, · For payments made in years before , nonemployee compensation was reported in Box 7 of Form 1099MISC While it is beyond the scope of this article to list all the possible payments reportable on Form 1099NEC, the form is generally used to report amounts paid as nonemployee compensation, such as fees, commissions, prizes, awards, or otherNonemployee Compensation (Form 1099NEC) Menu Path Income > Business Income > Form 1099NEC / 1099MISC Nonemployee compensation is usually reported on a Form 1099NECEnter this on the Add / Edit / Delete 1099NEC or 1099MISC Income screen The 1099NEC is not efiled to the IRS like a W2 is If you know where the 1099NEC income should be reportedDownload Printable Irs Form 1099misc, 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Online And Print It Out For Free Irs Form 1099misc, 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms

Freelancers Meet The New Form 1099 Nec

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

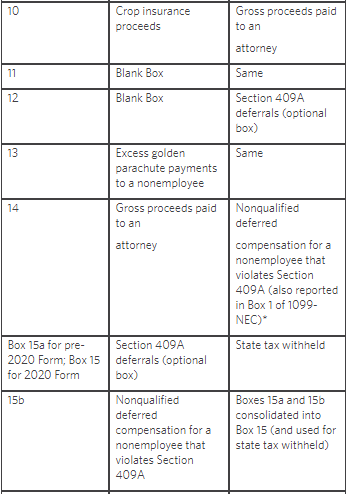

Mar 02, · The Internal Revenue Service (IRS) released its final version of Form 1099NEC, Nonemployee Compensation, on December 6, 19, to be used for reporting current and deferred compensation paid toForm 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 toWhat types of compensation needs to be reported on Form 1099NEC?

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png?resize=650,400)

What Is The Irs Form 1099 Misc And How To File It Cute766

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Jan 08, 21 · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISCJul 28, 19 · The Internal Revenue Service has resurrected a form that hasn't been used since the early 1980s, Form 1099NEC, Nonemployee Compensation, with a draft version available for preview on its website Since 19, the IRS has required businesses to instead file Form 1099MISC for contract workers and freelancersIt is for informational purposes and Internal

What Is Form 1099 Nec Who Uses It What To Include More

Setting Up And Processing Form 1099 For Recipients

Nov 25, · The IRS has introduced Form 1099NEC again, after 19, in order to avoid the confusion in deadlines for filing Form 1099MISC Form 1099NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099MISC Read on to learn more about Form 1099NEC Following are the topics covered in this articleFeb 11, 21 · Previously, businesses used Form 1099MISC, Miscellaneous Income, to report nonemployee compensation and a number of miscellaneous payments to vendors (eg, rent) Depending on your business activities during the year, you may need to prepare both Form 1099NEC and Form 1099MISC Form 1099NECTo avoid the fraudulent activities, the IRS separated the nonemployee payments to 1099 NEC Tax Form Committing errors Through 1099 NEC Tax Form, the tax payer may avoid the errors while filing the form As the 1099 NEC Form, gives the clear view regarding nonemployee compensation amount in the Box 1 Avoids penalties

Freelancers Independent Contractors Archives Taxgirl

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-175138802-5686c2193df78ccc15febf86.jpg)

Form 1099 Nec What Is It

Jan 22, 21 · Form 1099NEC pertains to reporting information relevant to nonemployee compensation It is not a replacement for Form 1099MISC as the latter is now reserved for reporting information pertaining to independent contractor payments Though this Form 1099NEC has been in use since 19, the IRS has revised it in to clear all the confusion pertaining toMar 25, 21 · For more specific information on what qualifies, please see page 10 and 11 of the Instructions for Forms 1099MISC and 1099NEC;Form 1099NEC, Nonemployee Compensation Taxpayers who are independent contractors should receive Form 1099NEC showing the income they earned from payers who are required to file Forms 1099 The use of Form 1099NEC to report payments to independent contractors is new for The amount from Form(s) 1099NEC, along with any other

Form 19

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractorSince the contractor is not a corporation and the amount paid is $600 or more, the contractor should receive a Form 1099NEC reflecting the $5,500 in Box 1 as nonemployee compensation Example 2 During , an organization pays a consultant, who is a sole proprietor, $2,000 of which $800 was a travel reimbursementOct 31, · If you pay any independent contractors for their services, the IRS recently made a change that will probably affect you starting with the tax year, instead of reporting nonemployee compensation (NEC) via Form 1099MISC, you must complete and file Form 1099NEC by January 31, 21 (or the next business day) It's a relatively small change, but you could

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

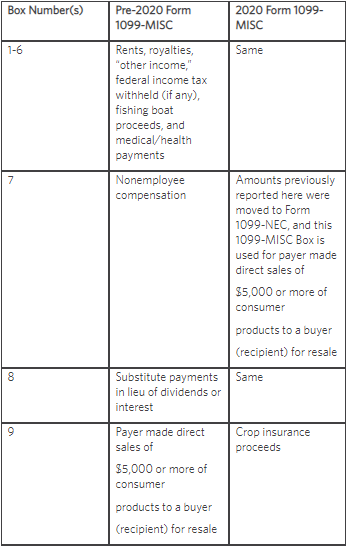

Essentially, the difference between forms 1099NEC and 1099MISC is that nonemployee compensation used to be reported in Box 7 of Form 1099MISC Now, Box 7 has been separated out into its own form NEC payments are now reported in Box 1 of this new form, 1099NEC Form 1099MISC still exists, but it has been modified and redesignedFeb 05, 21 · Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC Worksheet Press F6 on the keyboard to open the Forms List Type 99N on your keyboard to highlight the 1099NEC Wks Select OKDec 30, · Previously, you would be including nonemployee compensation in Box 7 on Form 1099MISC, but now it is turned into "Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale" In , "Nonemployee Compensation" must be reported by using Form 1099NEC

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Generally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employeeMay 19, 17 · Form 1099NEC If you paid an independent contractor $600 or more, you need to file Form 1099NEC , Nonemployee Compensation In order to fill out Form 1099NEC, the independent contractor needs to complete Form W9 , Request for Taxpayer Identification Number and Certification, when they begin work for youJul 13, · Form 1099NEC is the new IRS form starting in , and it replaces Form 1099MISC for reporting nonemployee payments The IRS has released the Form 1099NEC to report nonemployee payments This move affects almost all businesses within the US who need to report nonemployee compensation

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec Who Will Need To File It Youtube

Feb 02, 21 · "Form 1099NEC Worksheet (client name) A link to Schedule C and a link to either Schedule F, Form 19 (Wages) or the Other Income Statement have been selected to report nonemployee compensation Only one can be selected

1099 Nec Conversion In

Basics Beyond Tax Blast August 19 Basics Beyond

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Tax Forms Archives Taxgirl

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Ready For The 1099 Nec Ir Global

Nonemployment Compensation Box On 1099 Misc Form Dalby Wendland Co P C

Setting Up And Processing Form 1099 For Recipients

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

New Irs Rules For Reporting Non Employee Compensation With Form 1099 Nec Complyright

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Form 1099 Nec Is Coming Here S What You Need To Know

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Task Assignment Sheet Task Assignment Sheet Template Insymbio

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Setting Up And Processing Form 1099 For Recipients

Setting Up And Processing Form 1099 For Recipients

What Is A Schedule C 1099 Nec

Form 1099 Nec Is Coming Here S What You Need To Know

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

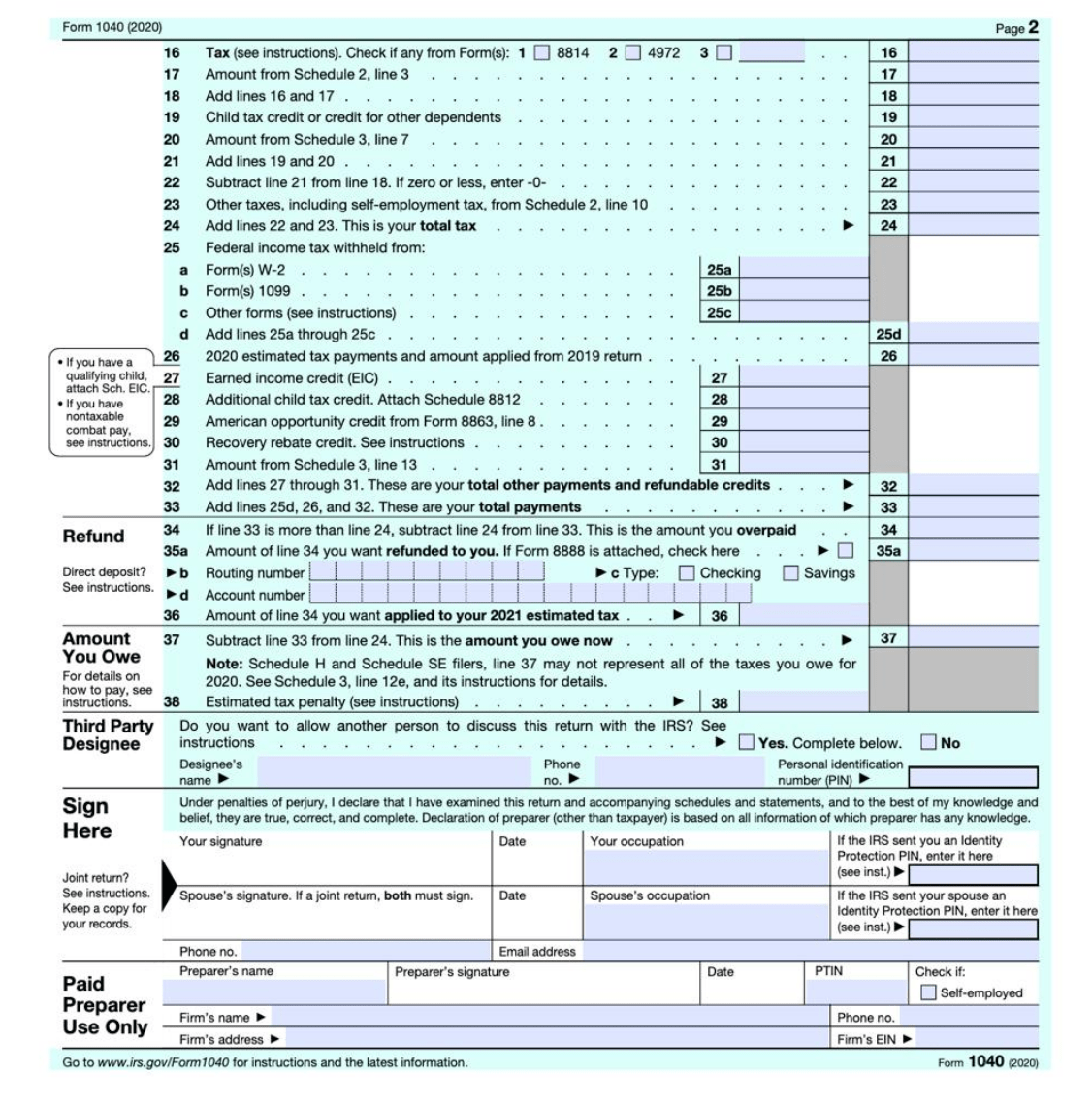

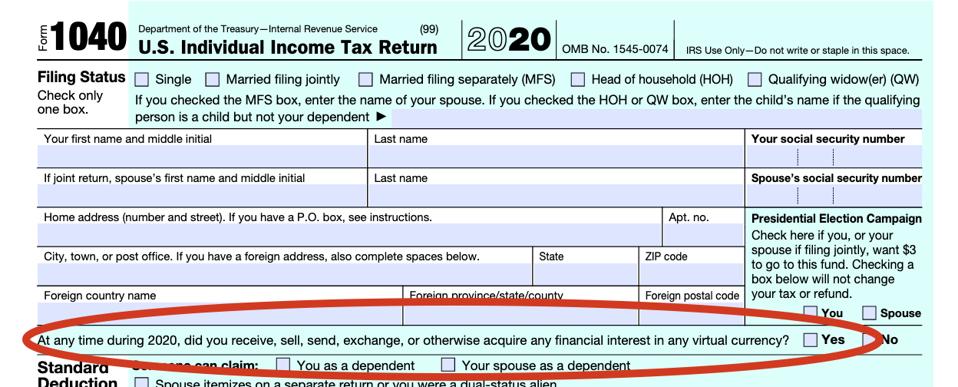

Irs Releases Form 1040 For Spoiler Alert Still Not A Postcard Sfb Brands

Tax Season 21 What You Must Know About New Reporting Rules Mystockoptions Com

What Is The Form 1099 Nec The Turbotax Blog

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Form 19 Reason Code

1099 Nec And 1099 Misc What S New For Bench Accounting

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Irs Releases Form 1040 For Spoiler Alert Still Not A Postcard Sfb Brands

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Basics Beyond Tax Blast August 19 Basics Beyond

Irs Releases Form 1040 For Tax Year Taxgirl

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Paper Doll S Tax Smart Organizing Tips 21 Best Results Organizing

Your Ultimate Guide To 1099s

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/1099-misc-form-non-employee-income-398362_updated_HL-c7c12d946b8f47689f520bc37e4efca8.png)

Form 1099 Nec What Is It

The New Irs Form 1099 Nec Summarized

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec Who Uses It What To Include More

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

What Is The Irs Form 1099 Misc And How To File It Cute766

Ready For The 1099 Nec Spatola Company Cpa Inc

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

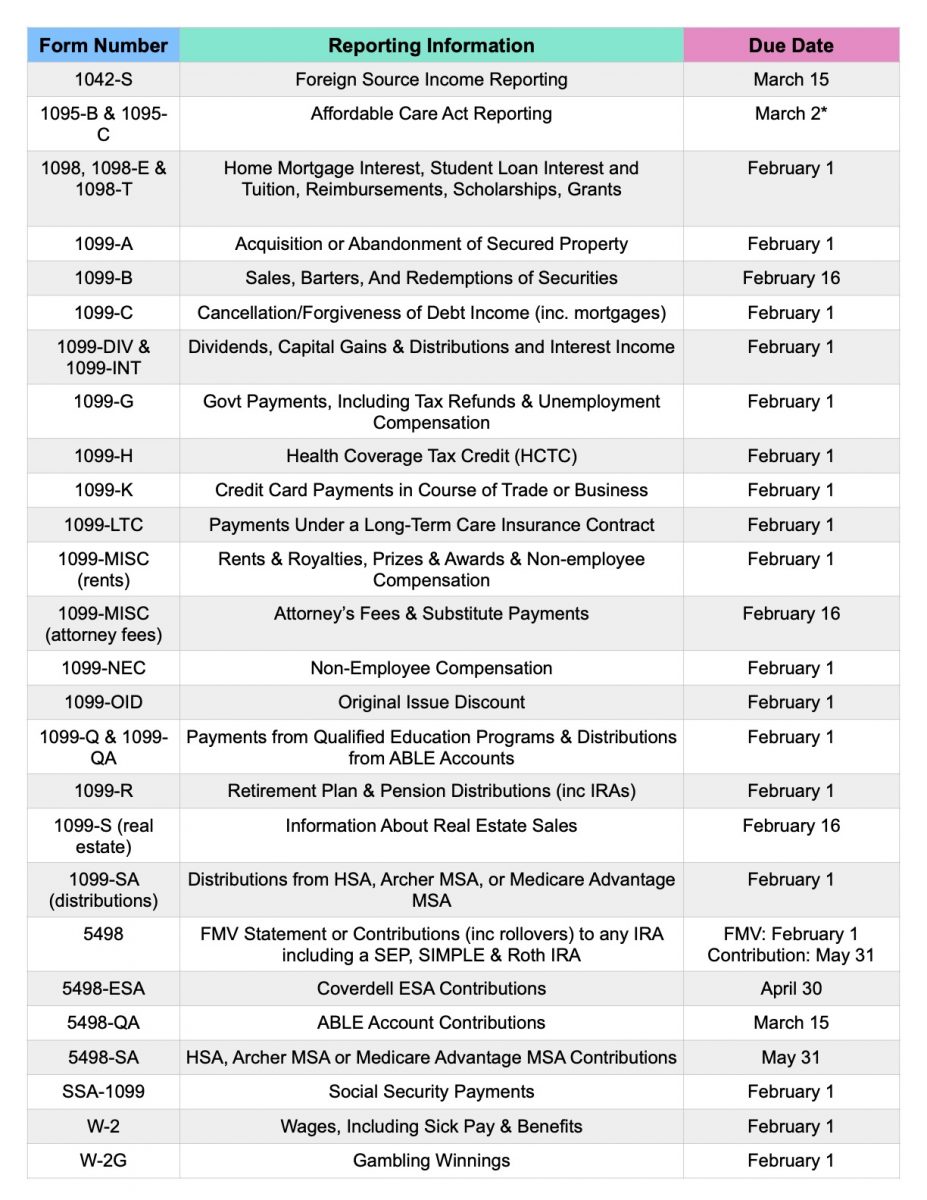

1099 Filings For Landlords 21 Edition Deadline Chart

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Pin By Social Media Marketing On Places To Visit 1099 Tax Form Fillable Forms Tax Forms

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Tax Forms Archives Taxgirl

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec Turbotax Tax Tips Videos

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Basics Beyond Tax Blast August 19 Basics Beyond

1099 Nec And 1099 Misc Changes And Requirements For Property Management

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Paper Doll S Tax Smart Organizing Tips 21 Best Results Organizing

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

/how-to-prepare-1099-misc-forms-step-by-step-397973-final-HL-ccf162add47a4d61bb61fca1ea3e3c62.png)

How To Prepare 1099 Nec Forms Step By Step

Setting Up And Processing Form 1099 For Recipients

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form 1099 Nec How To Fill Out This New Form Youtube

Common 1099 Processing Questions

0 件のコメント:

コメントを投稿