12/23/ · If you rent a machine (for example, a bulldozer to level your parking lot), you should prorate the machine rental on form 1099MISC and the labor of the machine operator on form 1099NEC Payments made to a legal service provider should be reported on form 1099NEC11/4/ · Filing Form 1099NEC With TaxBandits You can complete Form 1099NEC in a matter of minutes with TaxBandits All you have to do is create your free account and follow the interview style efiling process Helpful tips along the way to explain what information is required to complete your form and where it needs to be entered1099NEC data only for preprinted form;

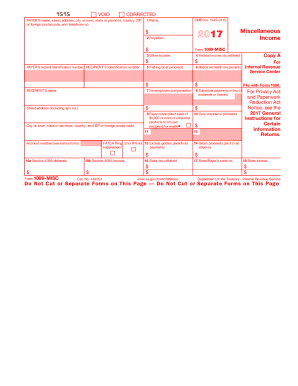

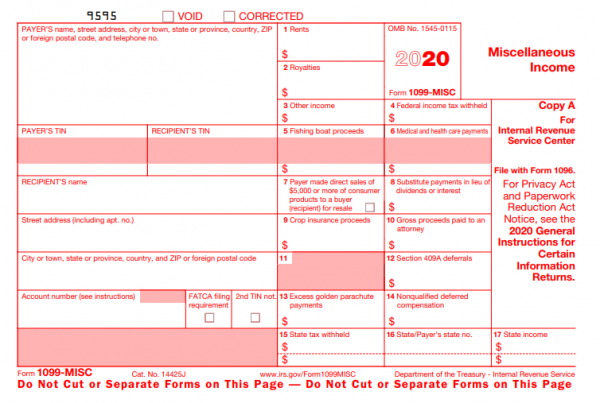

1099 Misc Form Fillable Printable Download Free Instructions

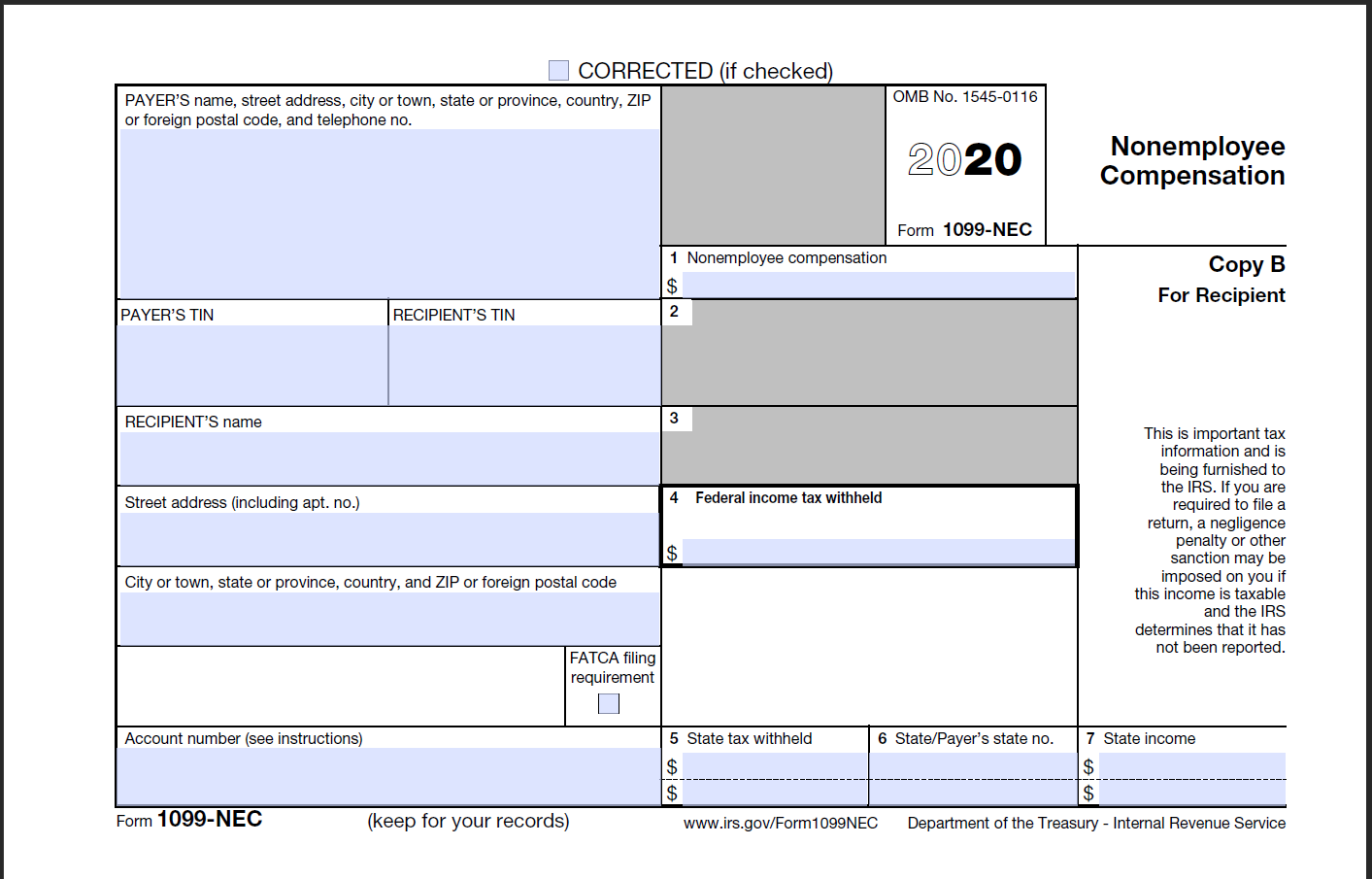

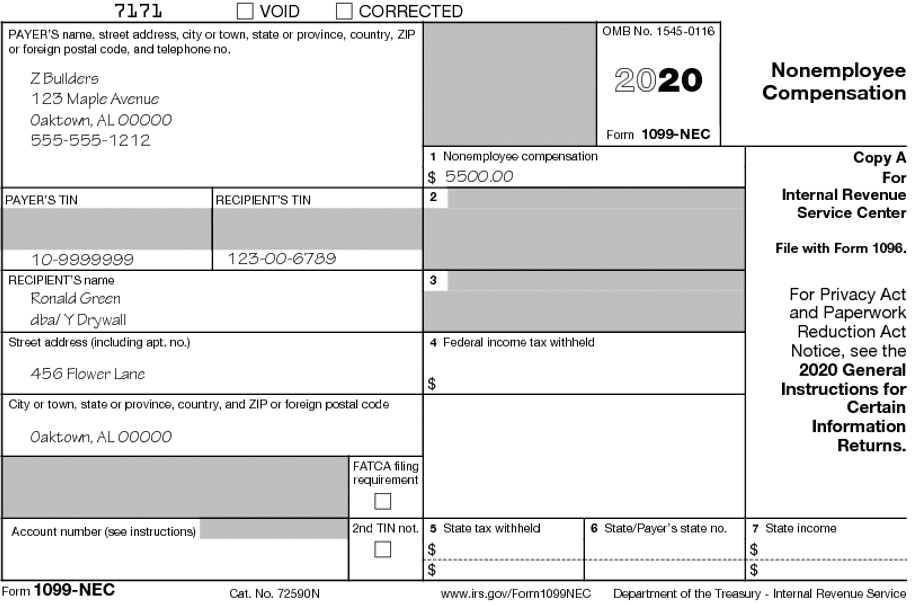

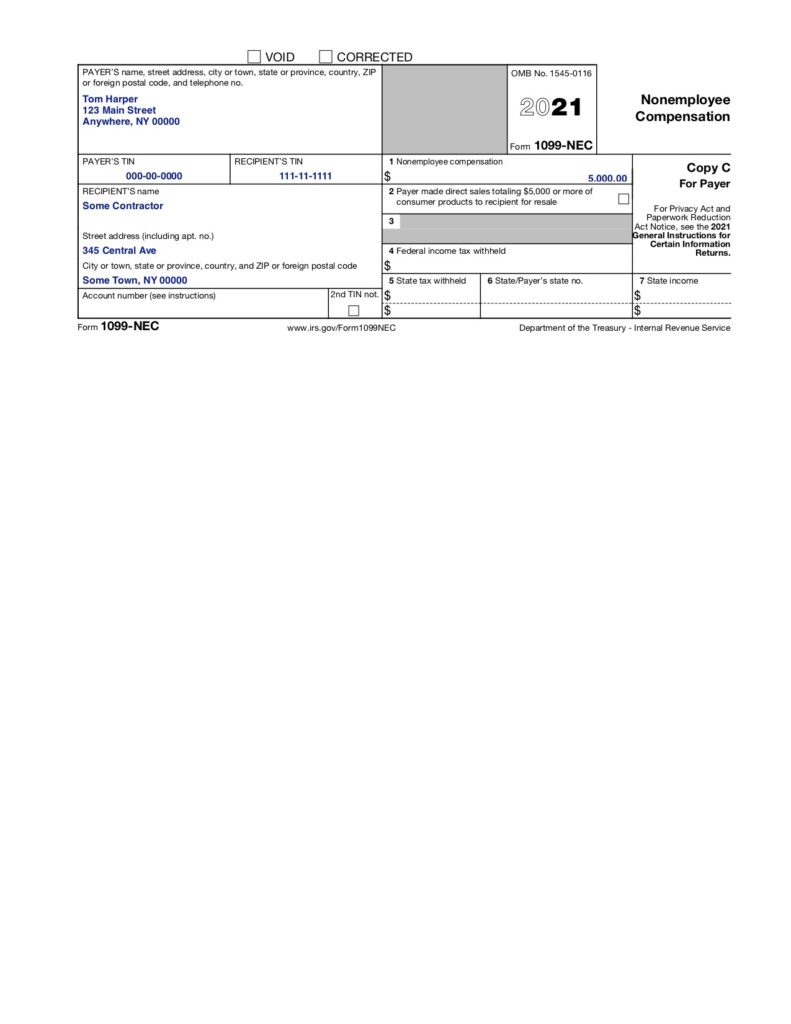

Example of completed 1099 nec form

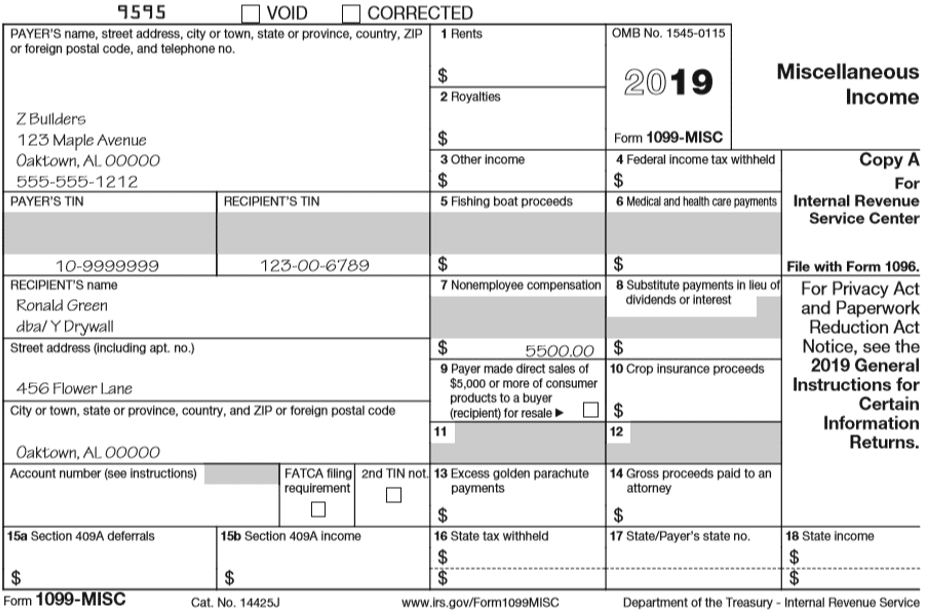

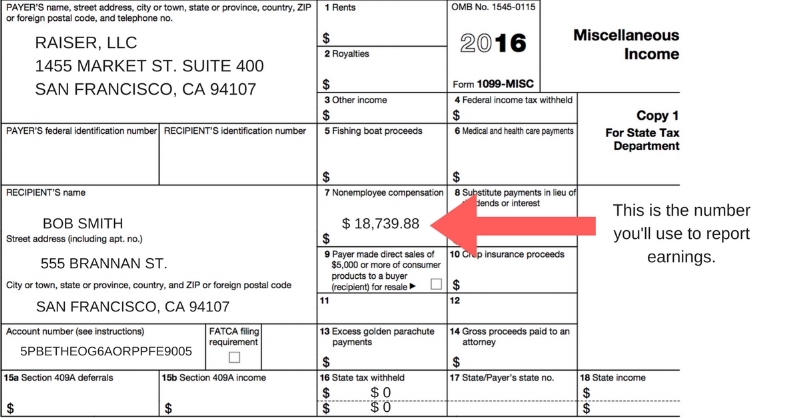

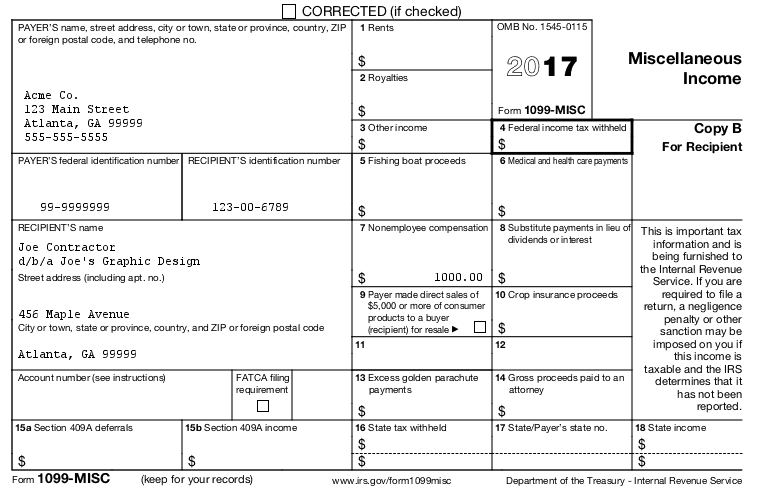

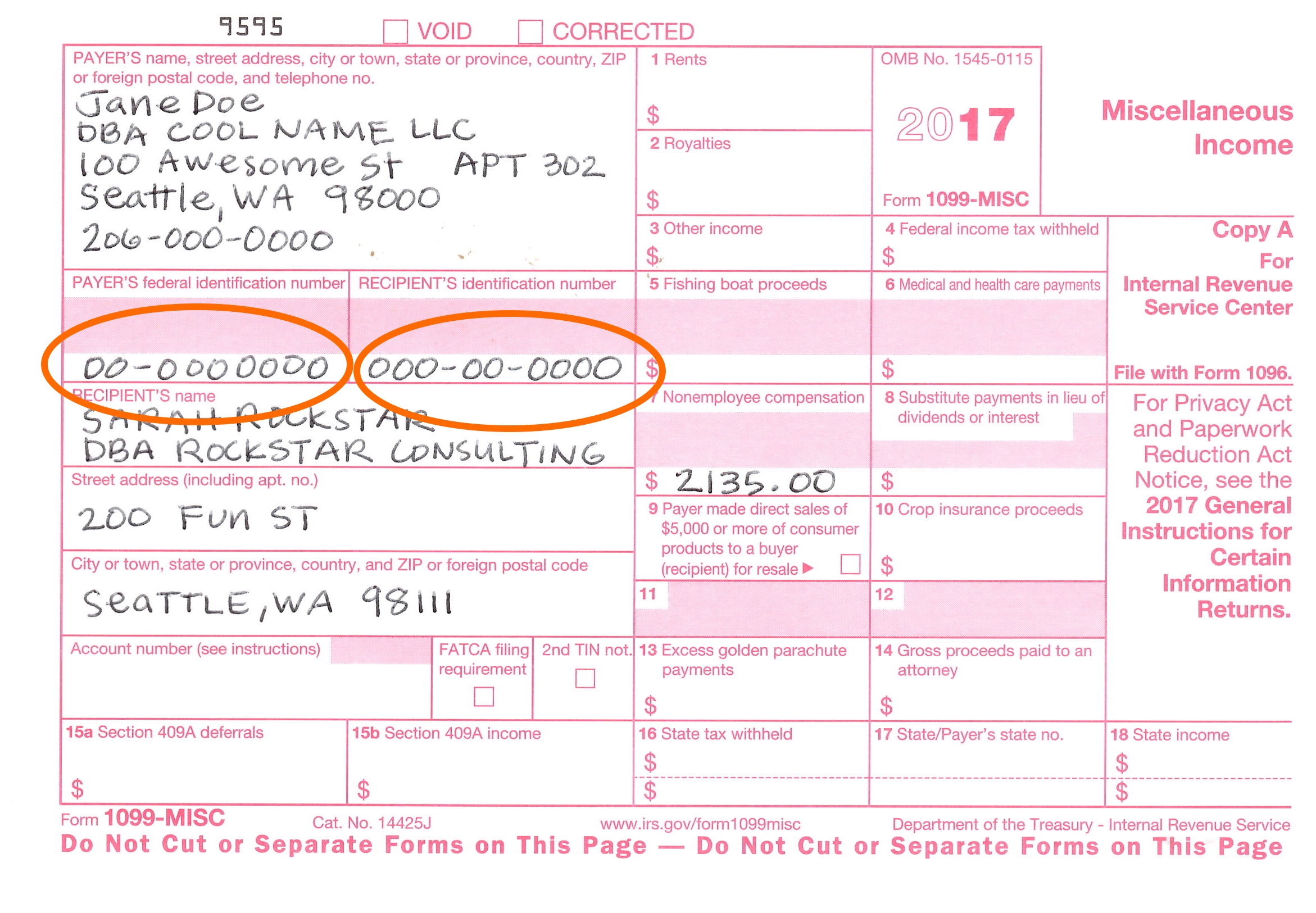

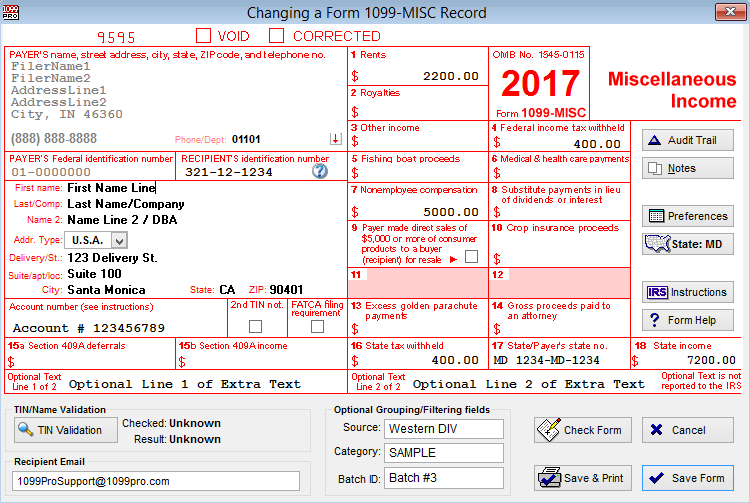

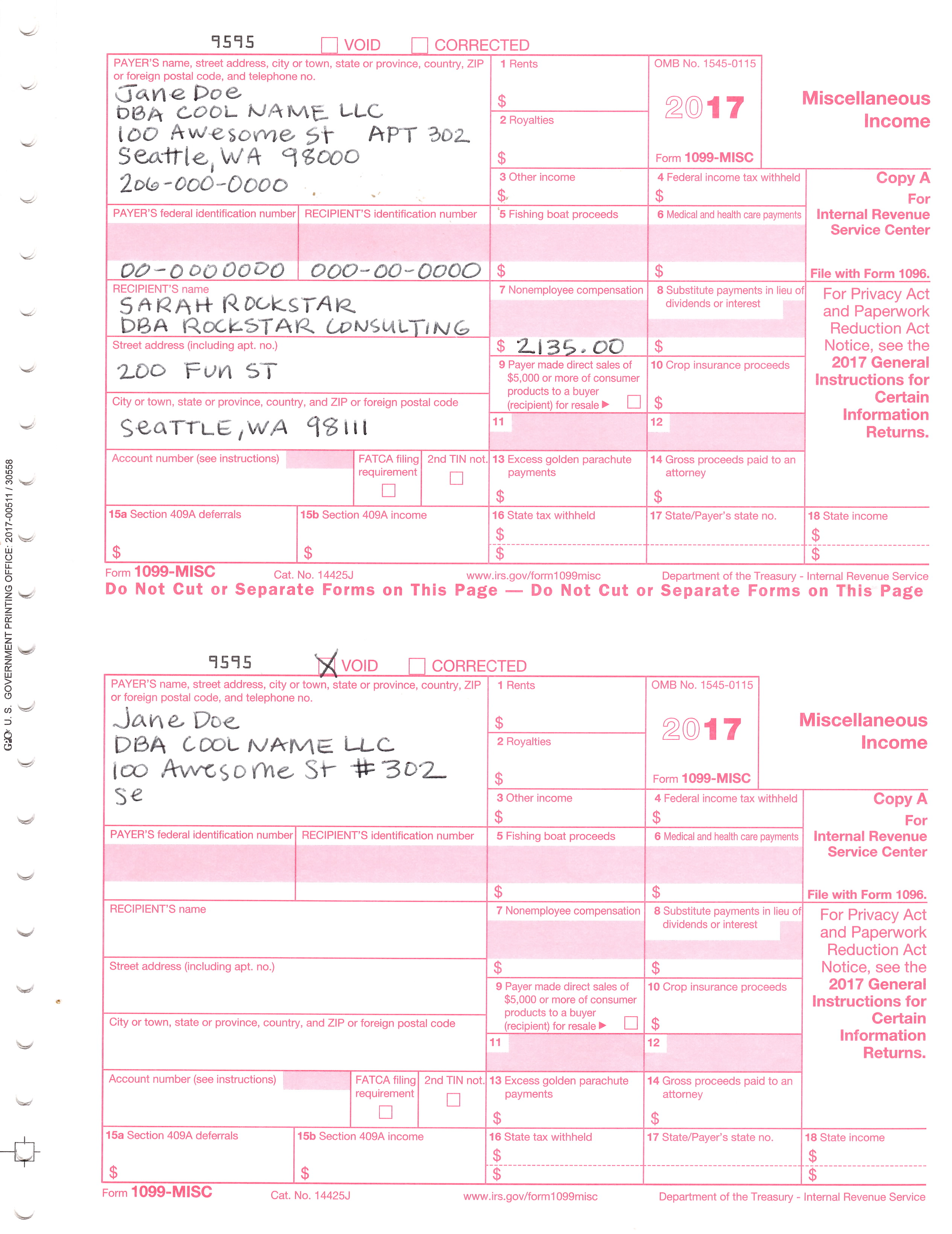

Example of completed 1099 nec form-3/25/17 · Even if the entity you compensate is a business, you are still required to issue a 1099 The exception to this is if the entity is a corporation or other 1099exempt organization 1099MISC instructions How to fill out the form Before you fill out a 1099MISC form, ensure that you order Form 1099MISC online or by phone Payer and recipient7// · When you pay for other services and part of the payment covered incidentals – the cost of parts or materials used to perform the services – you will complete Form 1099NEC When You Pay Commission If you have salespeople, you likely pay them a commission If they do not repay this commission during the year, you will report the total payment on Form 1099NEC If You

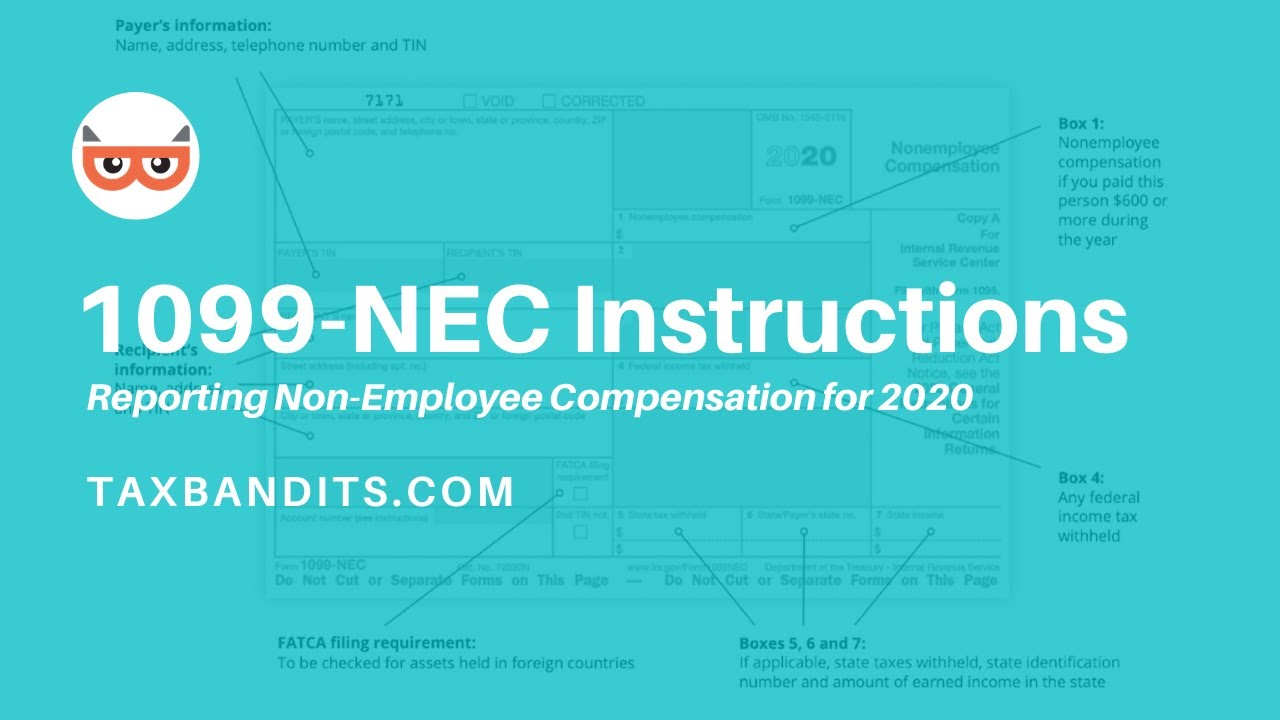

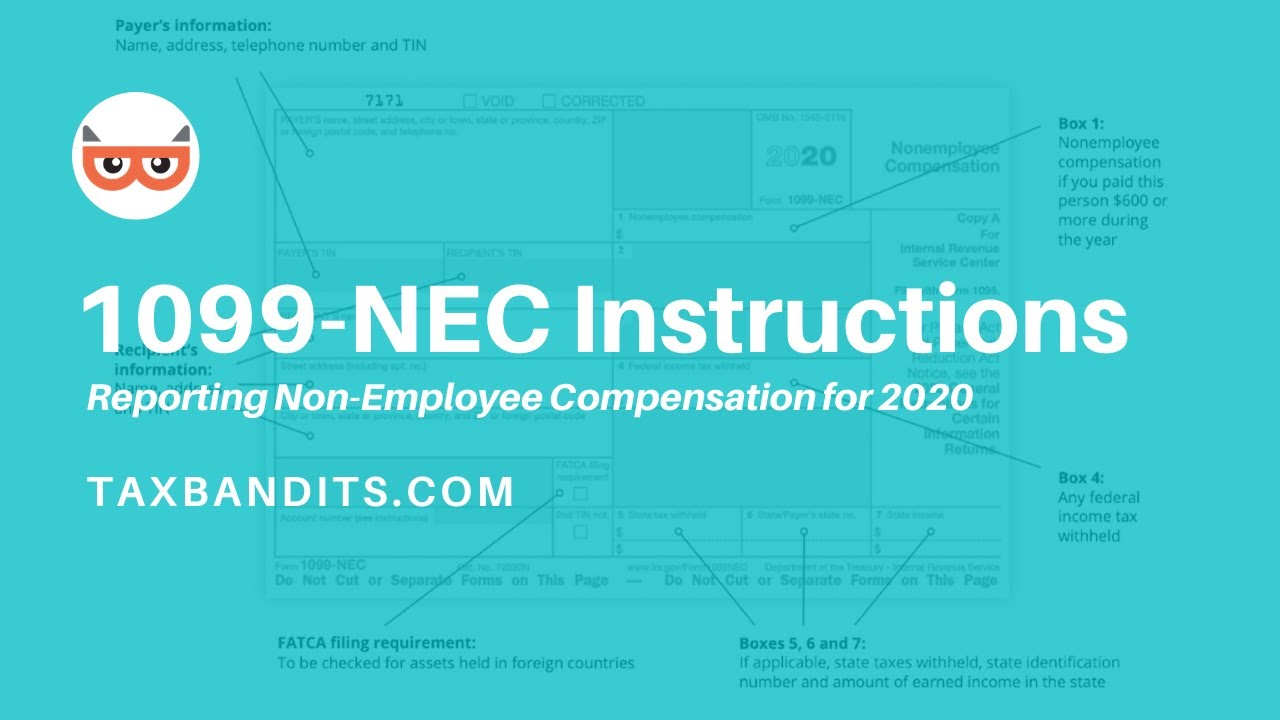

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

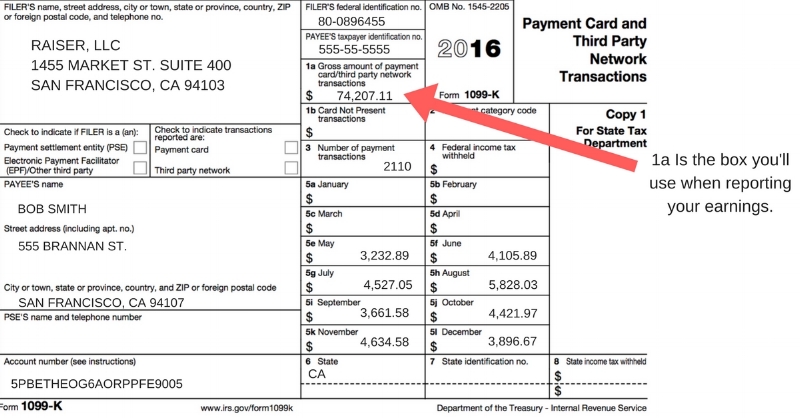

· 1099 example for independent contractors Suppose you're a freelance graphic designer, and a local coffee shop called Whole Latte Love pays you $1,000 to design their new logo You do the work, and they love it Come tax season, they send you a Form 1099NEC, just like they're supposed to · For example, payments to an attorney to resolve a dispute under a settlement agreement would be reported on the Form 1099MISC Any other attorney payments that are not reported on the Form 1099NEC Finally, the IRS says that attorney fees paid to a "claimant" (usually the plaintiff) need not be reported on a Form 1099The IRS is introducing a new Form 1099NEC to report nonemployee compensation, beginning with the tax year Indeed, form 1099NEC isn't a completely new form, it's a revived old form which hasn't been used in over 30 years The new 1099 NEC form replaces Form 1099MISC Box 7 for reporting nonemployee compensation

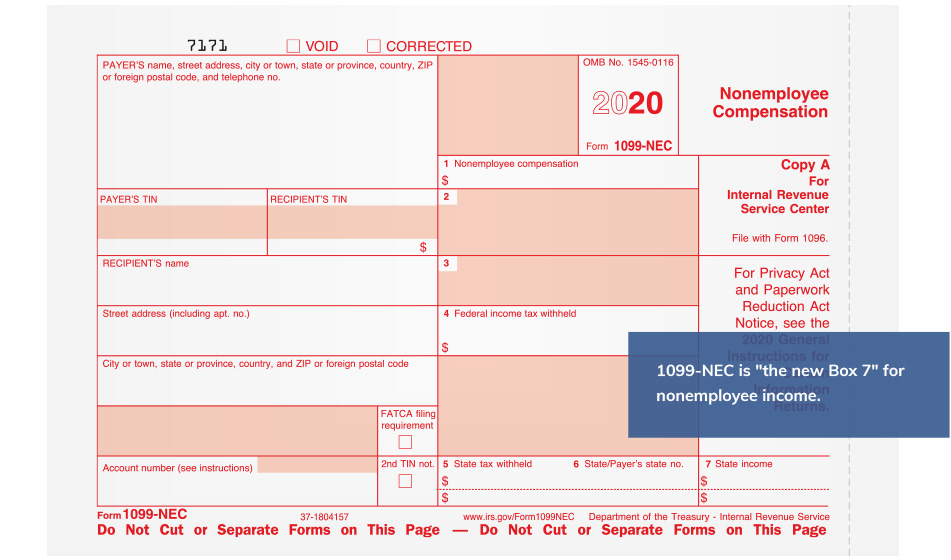

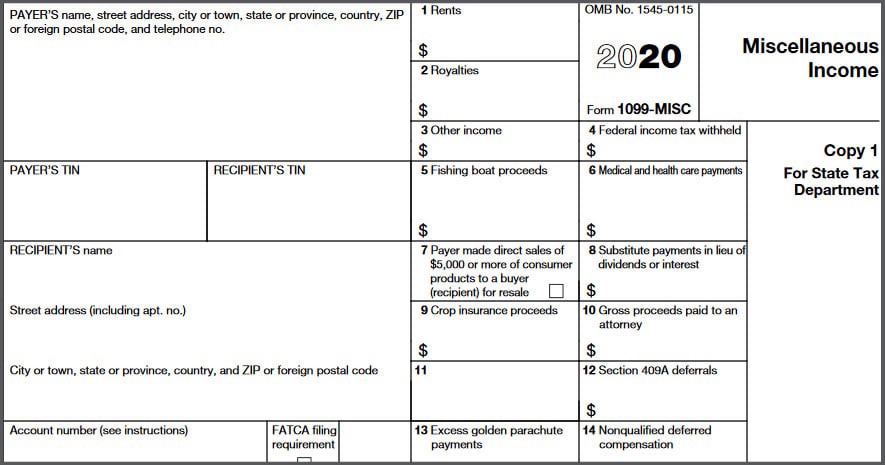

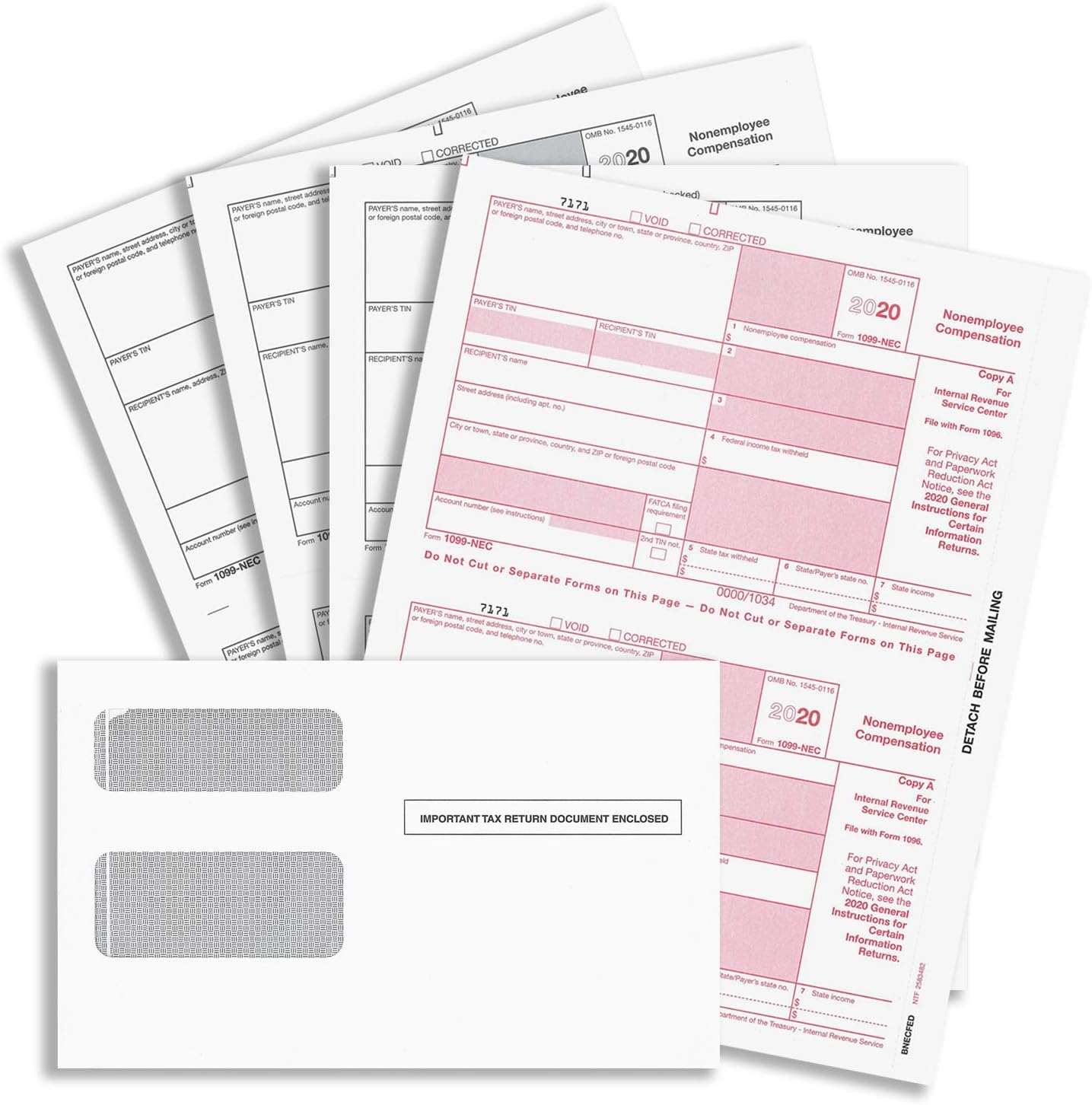

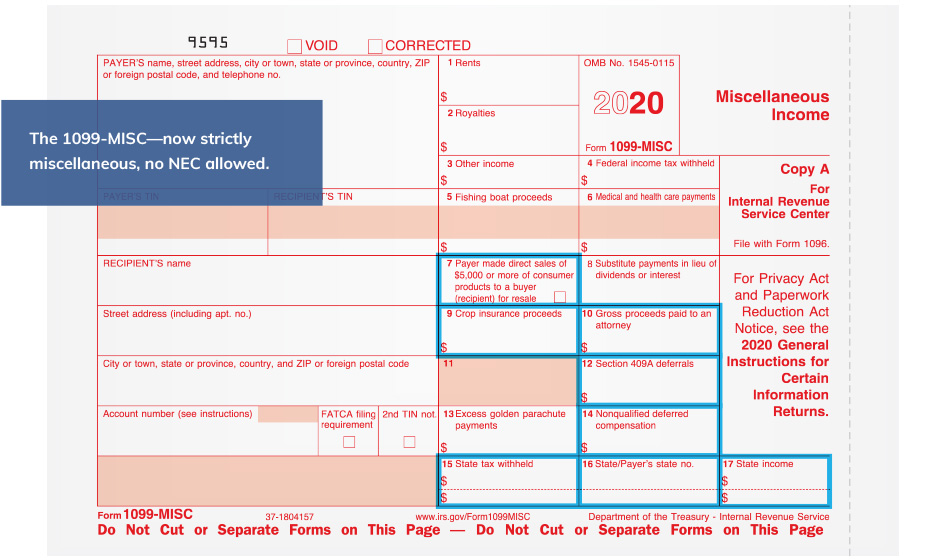

Copy 1 State tax department (if applicable) Copy B Contractor / Vendor;"Print, Mail, & eFile" orders must be completed by 2/1/21 at 7pm (PDT) "eFile Only" orders must be completed by 7pm (PDT) on 2/1/21 NEC State Reporting is Supported!12/3/ · Form 1099NEC, Nonemployee Compensation, is a form that solely reports nonemployee compensation Form 1099NEC is not a replacement for Form 1099MISC Form 1099NEC is only replacing the use of Form 1099MISC for reporting independent contractor payments And, the 1099NEC is actually not a new form It was last used in 19

Why IRS Introduced 1099NEC For ?1099NEC 21 Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 21 General Instructions for Certain Information Returns 7171 VOID CORRECTEDIRS Form 1099NEC is one of the most used forms in the series It is used to report payments made to nonemployees for services rendered Examples include payments made to providers of services, including independent contractors, freelancers, and others

What Is The Account Number On A 1099 Misc Form Workful

17 Form 1099 Misc Fill Out And Sign Printable Pdf Template Signnow

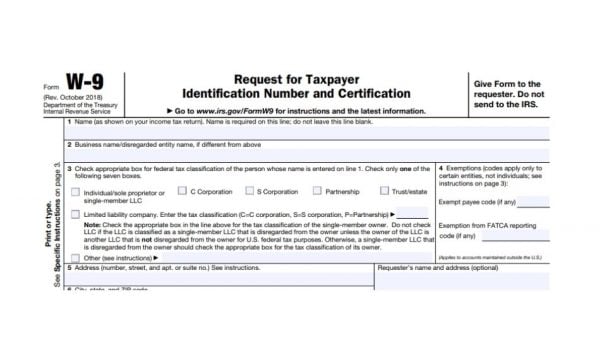

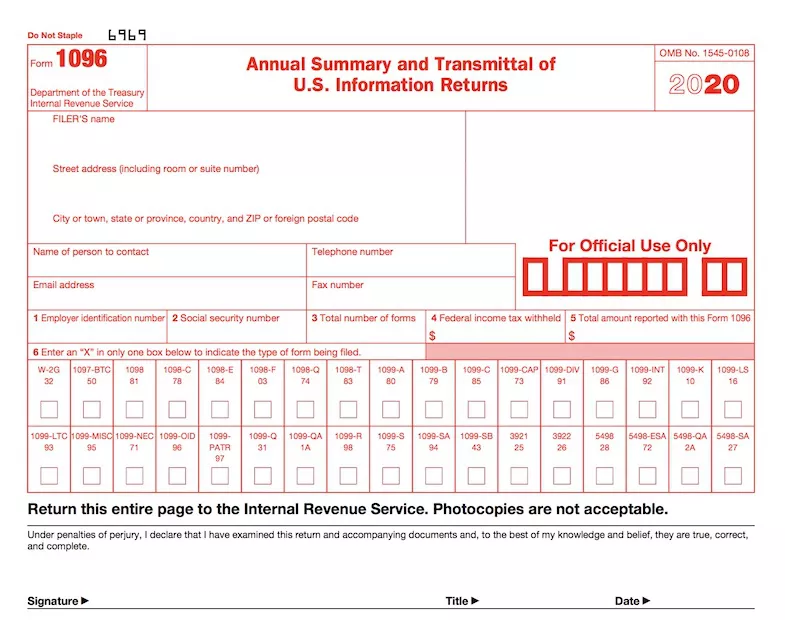

When you file Forms 1099MISC or 1099NEC with the IRS, you must also send Form 1096, Annual Summary andThe Form 1099NEC Income statement reports an owner's gross income paid by Chesapeake The form will also list any state or US withholding amounts deducted from a revenue check How does Chesapeake report a revenue check that is dated in DecemberForm 1099NEC wwwirsgov/Form1099NEC Sample Company 1456 SW Drive Chicago, IL SMITH M HAYES Line 2 Name 142 Happy Dr Suite 500 Banana City, CO NC/

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Nec And 1099 Misc Changes And Requirements For Property Management

The IRS has reintroduced Form 1099NEC as the new way to report selfemployment income instead of Form 1099MISC as traditionally had been used This was done to help clarify the separate filing deadlines on Form 1099MISC and the new 1099NEC form will be used starting with the tax yearI have also included an example of a completed spreadsheet Please see my flier for more information on the Form 1099 filing requirements If preparing yourself, Forms 1099NEC & 1099MISC can be purchased at most office supply stores They can also be completed and filed electronically using providers online I suggest wwwefilemyformscom1/8/21 · Before its reintroduction, the last time form 1099NEC was used was back in 19 Since then, prior to tax year , businesses typically filed Form 1099

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Prepare 1099 Nec Forms Step By Step

1099 Nec Software Software To Create Print And E File Form 1099 Nec

11// · NEC stands for "nonemployee compensation," and Form 1099NEC includes information on payments you made during the previous calendar year to nonemployees You must send a 1099NEC form to any nonemployees to whom you paid $600 or more during the year This form is NOT used for employee wages and salaries10/1/ · Companies using PayNortheast's online payroll service will have form 1099NEC completed and filed automatically at no cost When Is Form 1099NEC Due The due date for the 1099NEC form is Feb 1, 21, to both the IRS and to recipients10/31/ · If you pay any independent contractors for their services, the IRS recently made a change that will probably affect you starting with the tax year, instead of reporting nonemployee compensation (NEC) via Form 1099MISC, you must complete and file Form 1099NEC by January 31, 21 (or the next business day) It's a relatively small change, but you could

Form 1099 Nec How To Fill Out This New Form Youtube

Form 1096 A Simple Guide Bench Accounting

Copy C Your records;1/22/21 · However, if you file your 1099 NEC outside QuickBooks you'd want to secure a preprinted form and use it when reprinting your 1099 NEC copy A Here's how Purchase your 1099 Kit ;1/10/21 · Besides the filing of the 1099NEC form, you will also need to have the payee fill out and sign a Form W9 This is to get the correct Tax Payer

How To Fill Out And Print 1099 Nec Forms

Will I Receive A 1099 Nec 1099 Misc Form Support

1/25/21 · A 1099NEC form is used to report amounts paid to nonemployees (independent contractors and other businesses to whom payments are made) Nonemployees receive a form each year at the same time as employees receive W2 forms—that is, at the end of January—so the information can be included in the recipient's income tax return6/6/19 · For , the IRS has created a new form called 1099NEC, specifically for nonemployee compensation (compensation for work performed when the worker is not an employee) Nonemployee compensation will be in box 1 of form 1099NEC 1099MISC will only be used for other kinds of taxable payments (royalties, prizes, etc)1/13/21 · File 1099NEC when NEC calendar year payments total at least $600 Form 1099MISC (Miscellaneous) For calendar year Box 7 has been moved to the 1099NEC, Box 1 Several other of the 1099MISC boxes have been rearranged List below are some of the more common payments reportable on the 1099MISC File 1099NEC when these calendar year

Everything You Need To Know About The New Irs 1099 Nec Form

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

· Mailing Address for Form 1099NEC Updated on December 18, 1030 AM by Admin, ExpressEfile If you are thinking about paper filing Form 1099NEC this year, there's a lot to take into consideration Explore the following topics to get prepared, determine your IRS mailing address, and make the right decision for your businessSTEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation"1/22/21 · Next you need to figure out which 1099 tax form you need 1099NEC vs 1099K If you have reported any independent contractor income in the past, you are probably familiar with the Form 1099MISC Income from the tax year is going to be filed on Form 1099NEC, which is replacing the 1099MISC from last year

1099 Nec Form Copy B C 2 3up Discount Tax Forms

The New 1099 Nec

2/23/21 · Then, to verify your 1099NEC flowed to your Schedule C, please follow the steps below Search for Sch C with the magnifying glass tool at the top of the page Click on the Jump to Sch C link at the top of the search results On the page titled Your selfemployed work summary, you should see your 1099NEC's listed with the correspondingCopy 2 Contractor / Vendor;5/7/21 · The due date for payers to complete the Form 1099NEC is Jan 31 (Feb 1 in 21, due to Jan 31 falling on a weekend) Recipients receive a 1099NEC

1099 Nec And 1099 Misc Changes And Requirements For Property Management

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Prepare your 1099s in QuickBooks When complete, choose the Print and mail option Check if the forms align properly by selecting Print sample on blank paperClick Here to View All Form Deadlines1/5/ · In the event you do receive a 1099K, you must report your income accurately as the IRS also receives a copy of the 1099K Even if you do not receive a 1099K, the IRS can still request income information with Tax ID's as all platforms request this information This goes for all 1099 income Schedule C Example

How To Fill Out And Print 1099 Nec Forms

1099 Sample Forms

1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 7171 VOID CORRECTED2/1/21 · Sample Form Populated 1099NEC form Populated 1099MISC form Can it be sent to recipients by email? · For example, if Forms 1099NEC and 1099MISC are required to be filed, complete one Form 1096 to transmit Forms 1099NEC and another to transmit Forms 1099Misc Payments to Attorneys Attorneys' fees for services of $600 or more paid in the course of a trade or business are reported in box 1 of Form 1099NEC, regardless of legal

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Nec Form Copy B 2 Discount Tax Forms

The form samples include samples for preprinted as well as BIP versions of the 1099 forms You use the preprinted version ZJDE0001 for printing the form output on the office supply stock of 1099 forms where you only create the data on the already printed formSample 1099NEC The 1099NEC is being introduced for tax year Previously, these amounts were reported on Box 7 of the 1099MISC To read a brief description of a box on the 1099NEC, move your mouse pointer over a box in the sample form5/3/ · F1099nec Form 1099NEC This document is locked as it has been sent for signing You have successfully completed this document Other parties need to complete fields in the document You will recieve an email notification when the document has been completed by all parties This document has been signed by all parties Completed 30 April

Acumatica 1099 Nec Reporting Changes Crestwood Associates

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

12/30/ · The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Yes, you can email 1099NEC forms as long as you have the recipient's consent You can also mask the recipient tax ID on the form You will need W2 Mate Option #6 (Create PDF W2's and 1099's) in addition to W2 Mate to create PDF 1099NEC12/1/ · Both Form 1099MISC and 1099NEC have five copies, each going to the same parties Send the copies as follows Copy A IRS;

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Fill Out A 1099 Nec Check Stub Maker

Click the 'Print 1099 Forms' button to print the different 1099 Copies for this recipient ezW2 can print forms 1099nec copy A, B, C, 1 and 2 Click the 'Print Instructions' button to print 1099 instructions Sample Forms;2/1/21 · 1099NEC / W2 1099NEC & W2 Early Deadline The IRS requires 1099NEC records and all W2's to be printed, mailed, and eFiled by 2/1/21! · If you're involved in a trade or business, you must file Form 1099NEC to report any nonemployee compensation of $600 or more Nonemployee compensation includes fees, commissions, prizes, awards, and any other forms of compensation for services performed by someone who isn't classified as your employee

How To Fill Out And Print 1099 Nec Forms

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

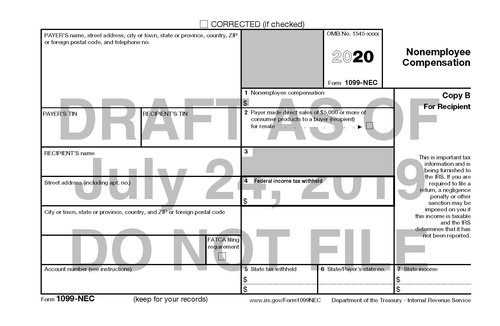

To use the "reinstated" 1099NEC The IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7)3/6/21 · The following sample is created using the instructions from the IRS publication 1099MISC/NEC InstructionsThe Form 1099NEC is the revival of a form that hasn't been used since 19 NEC stands for "Nonemployee compensation" You can see what a draft version of that form looks like here (The IRS warns This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099NEC is an old form but IRS reintroduce to avoiding deadline confusion Form 1099Misc used for reporting Nonemployee compensations up to 19 In that situation, the IRS provides different deadlines for reporting NEC and nonNEC payments If the filer, reports 1099NEC payments with otherHow can I file a Federal Form 1099NEC with the department?Note 1 Form 1096 will be generate automatically based on form 1099

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

New Jersey 1099 Nec Electronic Filing Software Format

12/8/ · A 1099NEC will be provided to vendors or subcontractors who worked for a period of time for an employer to complete a project, with total payments exceeding $600 Independent contractors or selfemployed contractors must still fill out aYou can submit any 1099NEC to Louisiana either electronically or by mail Paper copies of it should be attached to a completed Form L3 and mailed to Louisiana Department of Revenue P O

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

1099 Nec Form Copy A Federal Discount Tax Forms

New Form 1099 Reporting Requirements For Atkg Llp

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Misc Form Fillable Printable Download Free Instructions

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Nec5110

How Do You File 1099 Misc Wp1099

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1099 Nec Software 2 Efile 449 Outsource 1099 Misc Software

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 Nec Line By Line 1099 Nec Instruction Explained

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

1099 Nec Tax Forms Discount Tax Forms

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Solved 1099 Misc 1099 Nec

Form 1099 Nec Form Pros

How To File 1099 Misc For Independent Contractor

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Your Ultimate Guide To 1099s

How To Fill Out An Irs 1099 Misc Tax Form Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

1099 Nec Software Print Efile 1099 Nec Forms

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Misc Software To Create Print E File Irs Form 1099 Misc

Laser 1099 Nec Tax Forms 3 Part Set Costco Checks

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

1099 Nec What Is It And Why Is The 1099misc Dead People Processes

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

New 1099 Nec Form 1099 Tax Form Changes For With Filings In 21

1099 Nec Software 2 Efile 449 Outsource 1099 Misc Software

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Sample 1099 Misc Forms Printed Ezw2 Software

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

How To File Form 1099 Nec For Contractors You Employ Vacationlord

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Amazon Com New 1099 Nec Forms For 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

The New 1099 Nec

How To File Form 1099 Nec For Contractors You Employ Vacationlord

How To Fill Out And Print 1099 Nec Forms

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Gosling Company Certified Public Accountants

What Is Form 1099 Nec Who Uses It What To Include More

Order 1099 Nec Misc Forms Envelopes To Print File

Form 1099 Misc Vs Form 1099 Nec How Are They Different

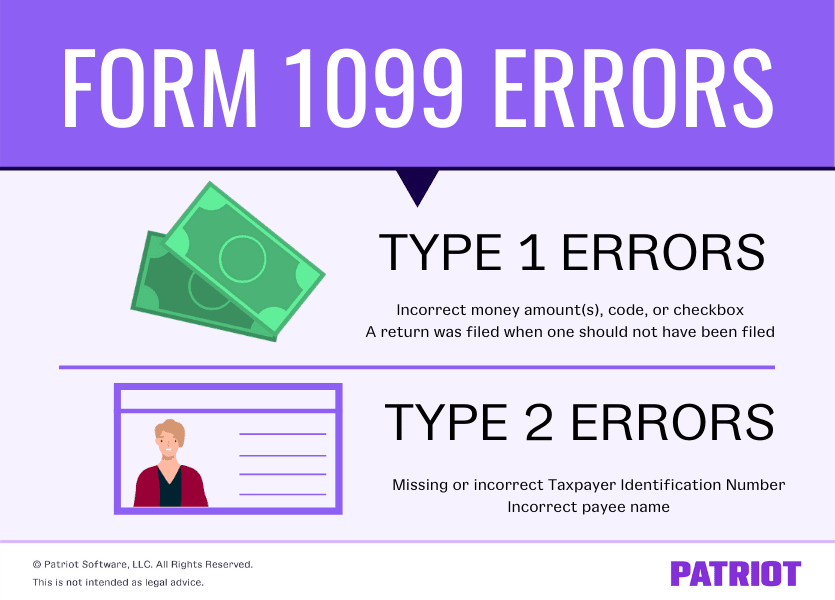

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec 1096 Template 1099misctemplate Com

1099 Misc Form Fillable Printable Download Free Instructions

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Fill Out And Print 1099 Nec Forms

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

0 件のコメント:

コメントを投稿